Simplified tax filing to claim your stimulus payments

Stimulus Payments

Relief to help you through these difficult times, even if you make little or no money.

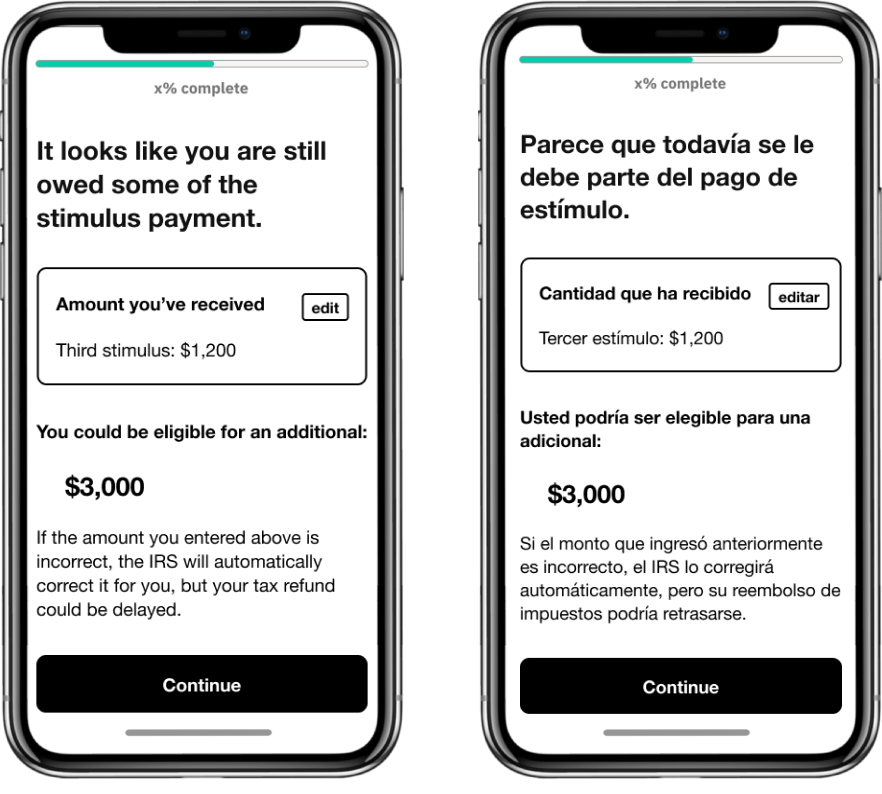

Congress passed three rounds of stimulus checks in response to the COVID-19 pandemic, in April 2020, December 2020, and March 2021. All together, the payments are worth up to $3,200 per adult and up to $2,500 per child in your family. The payments are formally known as Economic Impact Payments (EIPs), or as the Recovery Rebate Credit (RRC).

You can act now to get any of the three payments you haven’t yet received. If you have kids, you’ll also be able to sign up for payments of the new Advance Child Tax Credit.

GetCTC is a Code for America product. Why do we do this work?

Made in collaboration with the White House and U.S. Department of Treasury.

IRS-approved official E-file provider.

Are you a community partner helping someone else access the CTC or EITC?

Visit our resource page for navigators.

Visit our resource page for navigators.