A tool to claim the Advance Child Tax Credit

Sign in here to view your 2022 Advance Child Tax Credit forms.

For questions or help filing your taxes visit GetYourRefund. If you haven't filed yet this year, you might be eligible to claim cash benefits.

Most families can get thousands of dollars from the Child Tax Credit

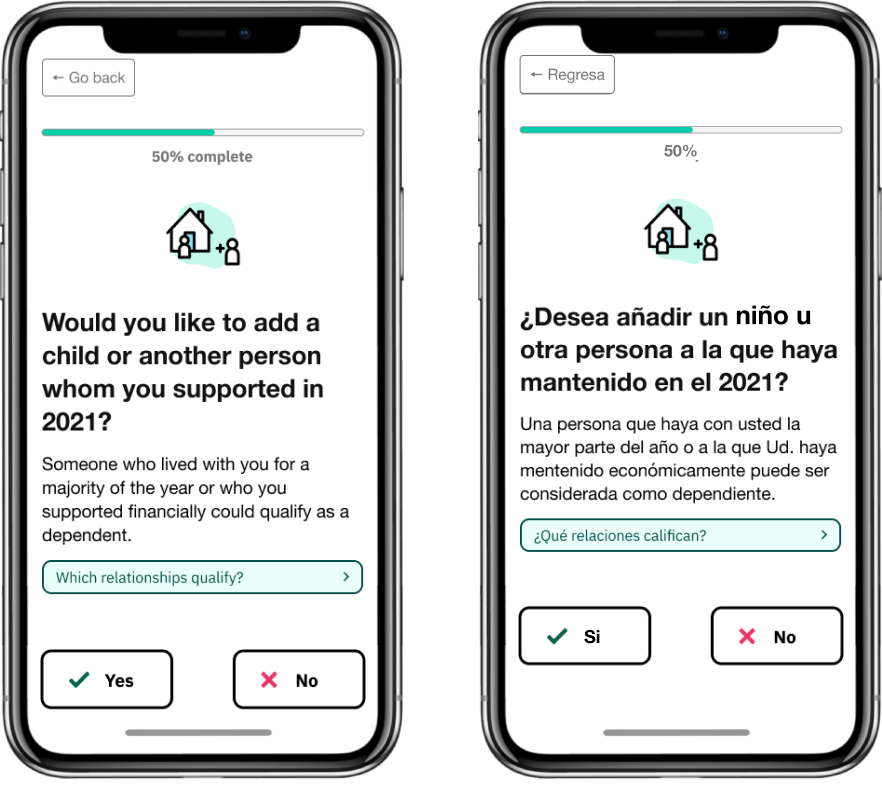

Putting cash in your family’s pocket for the things you need, even if you make little or no money.Your children probably qualify if they lived with you for most of 2021, they were under 18 at the end of 2021, and they were not born in 2022. GetCTC will walk you through a few quick questions to make sure.

The Child Tax Credit for tax year 2021 is up to $3,600 per child under 6, and $3,000 per child age 6-17.

If you received any monthly Advance Child Tax Credit payments in 2021, you need to file taxes this year to get the second half of your money. The rest of your Child Tax Credit will be issued in one payment.

If you have not received any Child Tax Credit payments yet, you can file simplified taxes now to get the whole credit.

The Earned Income Tax Credit is calculated by the amount of earned income you received in 2021, your filing status, and the number of qualifying children claimed as dependents on your simplified tax return. The credit is a range from $560 to $6,935 based on your specific tax situation.

Visit our resource page for navigators.